Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

If you have spent any time following recent technology trends, you would of almost certainly encountered the newest breed of AI, like ChatGPT and DALL-E. The hype cycle for these technologies is at an all-time high. However, of all industries, construction still is ripe for the highest likelihood for automation – from the design to offsite fabrication facility and into the field.

And yet despite this, construction is the industry with the lowest penetration of digital technology. Considering that the construction and engineering industry is responsible for designing, building and maintaining landmarks around the world and that it plays a critical role in the functioning of modern economies by delivering state of the art buildings for health care, education, and other critical infrastructure, this comes as a surprise to most.

Given the importance of the construction and engineering industry for the functioning of economies, Autodesk has commissioned independent research to analyse the trends impacting the industry and the level of digital adoption across Australia, Japan and Singapore.

What we found was clear – those construction firms that are leading the way in technology adoption are also outperforming their peers in growth.

The Australian Securities and Investments Commission (ASIC) figures for the 2021-2022 financial year ‘only’ record 1,284 construction company collapses. But the first quarter of the 2022-23 financial year alone saw almost half that figure taken down in the span of three months, with 605 construction companies going under.

The industry also faces uncertain economic conditions – high inflation, ever-rising interest rates and significant labour shortages.

And yet, despite that, a full quarter of the construction businesses we surveyed say they are optimistic about the next 12 months. And more to the point, the firms using more technology than average are 30% more likely to be optimistic about the future.

The research found a direct positive correlation between technology adoption and revenue growth expectations – the more types of new and emerging technology a business was using, the more revenue they expected to bring in over the next five years.

More than two thirds of businesses surveyed said using new technology to deliver client work would be a main source of revenue growth, while half said that growth would also come from using digital tech to improve internal processes.

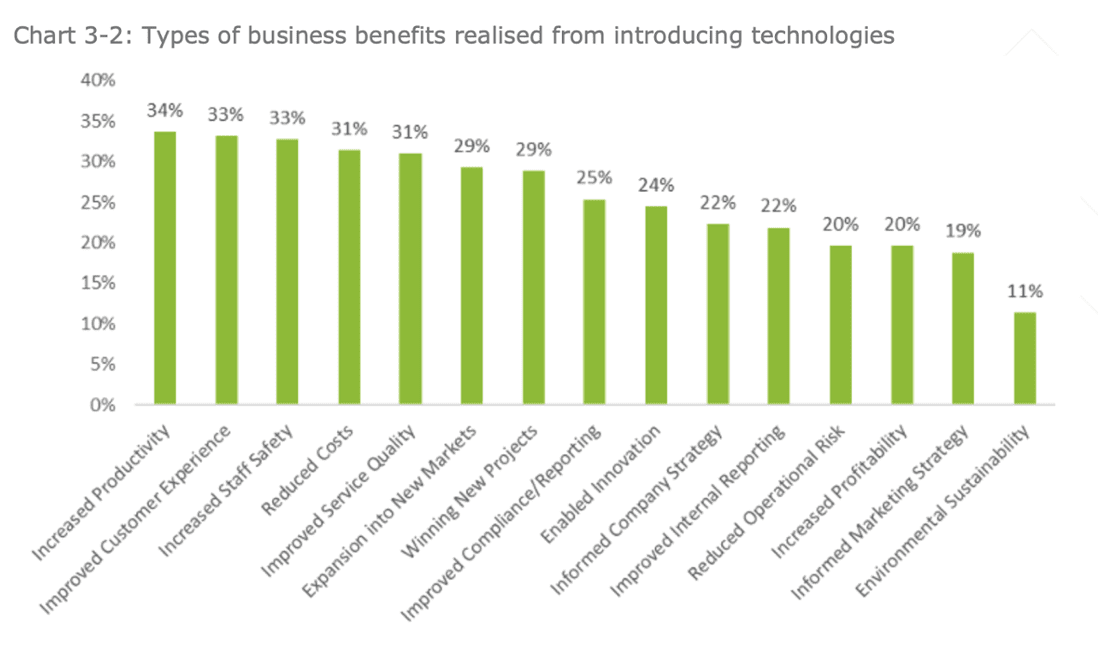

Giving credence to these claims is that almost all businesses – a full 96% – reported that previous digitisation efforts had boosted their business. For about half, the impact has already been deemed high or very high.

When construction firms were asked what technology they were deploying, they had a list of 16 emerging options from drones to 3D printing, from smart sensors to augmented reality.

But the clear winners in were BIM and construction management cloud software, which two in five firms already have in use. A further 25% also plan on adopting at least one of these tools in the coming year.

This is a crucial point, as both technologies are foundational stepping-stones for other advanced technologies.

The firms that are using BIM, for example, were more than twice as likely to also be using AI, machine learning or augmented reality. They are also more likely to be adopting 3D printing or prefab construction.

It is well understood that BIM combined with construction management cloud software can be the digital backbone for a construction company to help manage the increasingly complex projects that are faced from stakeholders to deliverables.

It is something that the team at Beca understand well. Digital and Innovation Leader Tim Mumford told us that where the engineering consultancy was seeing the most value from technology is by creating common data environments and allowing interoperability.

According to Mumford aligning the right technology with the right processes is allowing them to link people with data more effectively than ever before, creating the consistency and certainty that makes integrated project delivery achievable.

“We can now, in near real time, link our design choices to potential trade-offs in schedule, capital costs, ongoing costs, carbon, or functionality,” he said.

“Technology and processes underpin the growing complexity of major projects.”

Interestingly, only two in three of the firms surveyed agreed that new technology was essential to remain competitive.

However, nine in 10 reported investing in new technology during the last financial year. On average, these investments accounted for 17% of total business spend, which demonstrates the importance that is being placed on technology.

While it’s taking some time for the construction industry to play catch up when it comes to digitalisation, the numbers offer a clearer picture. Between 1989 and 2021, labour productivity – the output of each Australian worker – grew by 1.8% a year. In the same period construction industry productivity experienced only 0.5% annual growth. New technology is the key to closing the gap.

Industry tools are improving every day, and momentum is building for construction to transform its day-to-day operations. Knowing that your business could benefit from a new tool is a long way from having that tool successfully implemented.

That’s why as part of this research, we also delved deeply into the blockers and enablers of successful tech adoption, but that’s a discussion for another time.

This is just a glimpse of the insights contained in our research. To learn more about tech adoption, enablers and blockers, and change management for construction businesses, join me and David Rumbens from Deloitte as we discuss the findings in our State of Digital Adoption in Construction webinar. Register here.

May we collect and use your data?

Learn more about the Third Party Services we use and our Privacy Statement.May we collect and use your data to tailor your experience?

Explore the benefits of a customized experience by managing your privacy settings for this site or visit our Privacy Statement to learn more about your options.