Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

Both construction office and field operations will be forever changed with the rise of remote work and new site and safety protocols. New ways of working have emerged, and we have seen how fragile our existing ecosystems are. This global crisis offers an unprecedented and pivotal opportunity to transform how we build.

Beyond the new day to day shift, the current crisis has been a forcing hand in highlighting how the industry can no longer accept the status quo including low productivity, low predictability, low margins, adversarial pricing models, financial fragility, lack of collaboration, lack of investment in R&D and innovation. The risk of commoditization is higher than ever for incumbent players, even the largest ones. New questions and discussions are emerging in an in-depth manner, as they will set the foundations on how the construction industry goes forward once some semblance of normalcy is regained.

An easy way out of the grips of this crisis does not exist. But there is a more prospective alternative—transformation of Business Models. As I extensively discussed in our 2020 Trends Webinar at the start of this year, these changes will not just be the “trend” of 2020; it will be the “trend” that reshapes the decade, perhaps even longer. Companies will have to grasp this in order to survive and thrive. Inventing alternative Business Models is not a luxury; it is the condition for future successes.

Since the dawn of the Information Age, Technology, and with it, Innovation has been boundless. With that comes fundamental societal changes. Data is the new oil, and Information is the new virtual dollar that companies wield. Yesterday, Innovation was a rare breakthrough; today, it is the requirements of aspiring entrepreneurs and companies looking to generate an even larger profit. In the future, the very nature of innovation and disruption will change.

Disruption is also prevalent in the market. The consequences of innovation are breaking up traditional concepts or norms, or in this case, something originating from outside the market. While some construction firms have developed ad-hoc technology solutions to manage the shift to remote work in the face of this crisis, it remains to be seen whether these practices will be kept in place post-crisis. These companies found themselves torn between the demands of radically new realities imposed by “the New Normal” and the deep-rooted necessity to transform digitally. Meanwhile, clients are increasingly concerned that the sector is not keeping pace with the rates of improvement seen in other sectors of the economy.

When the construction industry talks about significant changes, it will no longer be just about what the next building style or new technology that firms should adopt, but rather how our industry would mold itself for the future. The construction industry shall change in the very way it is structured and its services rendered. Technology is just a puzzle piece, whereas true and sustainable innovation does not come from technology alone; it comes from new Business Models. These transformations are invisible to the eye, but they are happening. Building, infrastructures, cities look unchanged, but the underlying business delivery networks are being revolutionized. Disruption already significantly changed how the Telecom, Media, Retail, Transportation, Music, and Hospitality industries are structured. Construction is no exception. While, across the globe, the Construction Tech ecosystem is blooming, new players and incumbent firms launch strategic initiatives to improve their current market position, to build their future competitive advantage, and to prepare for the next wave of transformation. Most of the time, these strategic plans are kept confidential and are kept unknown to the general public.

Over nearly half a year, we’ve seen the toll the pandemic has taken on many businesses, whether local or international, small or large. Many companies have been forced to take drastic measures to reduce costs—through shifts in labor, marketing campaigns, or general service. Construction companies have not been excused. Even before the crisis occurred, signs were showing cracks in the entire industry. The tipping point had been achieved. It seems that reverting to “business as usual” is no longer an option.

Of course, is this the first crisis that we have weathered? No. History doesn’t repeat itself, but in many cases, it rhymes. Examining a report that BCG made regarding the 2008 financial crisis, it can be seen that 80% of the S&P Global 1200 companies had reactionary tendencies, as opposed to enacting proactive procedures. This entailed that they waited until their businesses took a downturn before beginning to focus on mitigation. On the other hand, the 25 top performers had increased liquidity and proactively invested in strategic acquisitions. This is a concrete example of how “fixing it before it breaks” is a decisive philosophy in a rocky market.

Let’s take a look at an example. Second in the S&P rankings, a US health care equipment company, Abiomed, was focused on developing the world’s first artificial heart in the 1990s. But in 2005 the company purchased Impella, a heart pump technology. Today, Impella accounts for the majority of the Abiomed’s revenue. Proactivity had allowed Abiomed to complete a large-scale pivot that could position it for growth, even in turbulent times.

Another story from a well-known brand: Starbucks had Howard Schultz returning as their CEO when the recession hit. He took it upon himself to decide to transform the customer experience—by returning the brand to its roots. Making the customer feel welcome and cared for became the top priority, along with high-quality control and standards for their products. To achieve such a goal, Starbucks emphasized its own people. They began to invest in store managers, giving them more opportunities to demonstrate value to the business, thus giving them a voice and a sense of ownership for the brand. At the same time, the company closed all of its US branches for half a day in order for baristas to relearn how to make expresso. Starbucks soon climbed from 89th in the 2009 BrandZ valuation index to 72nd in 2011, from valuation at $7,260m to a +40% change at $11,901m. Today, it sits at number 24 with a valuation of $45,884m. The move by Howard Schultz and Starbucks was widely lauded as a terrific investment.

To adapt to changing needs during the crisis, we are witnessing companies making “tweaks” – anything from slightly adjusting their model to comply with social distancing methods to adopting tools to enable employees and managers to work remotely. We have also heard executives re-evaluate their operating models in response to the crisis. More and more construction firms think that if they act now to modernize their operations and diversify their activities, they will be more robust, and it could help them adapt to future disruptions.

But to mirror the stories as told above, dealing with a market in turmoil needs more than just a few tweaks. From a new report from McKinsey & Company: “Organizations that make minor changes to the edges of their business model nearly always fall short of their goals. Tinkering leads to returns on investment below the cost of capital and to changes (and learning) that are too small to match the external pace of disruption.” The majority of incumbents fail to develop and implement radically new business models in parallel to their core business.

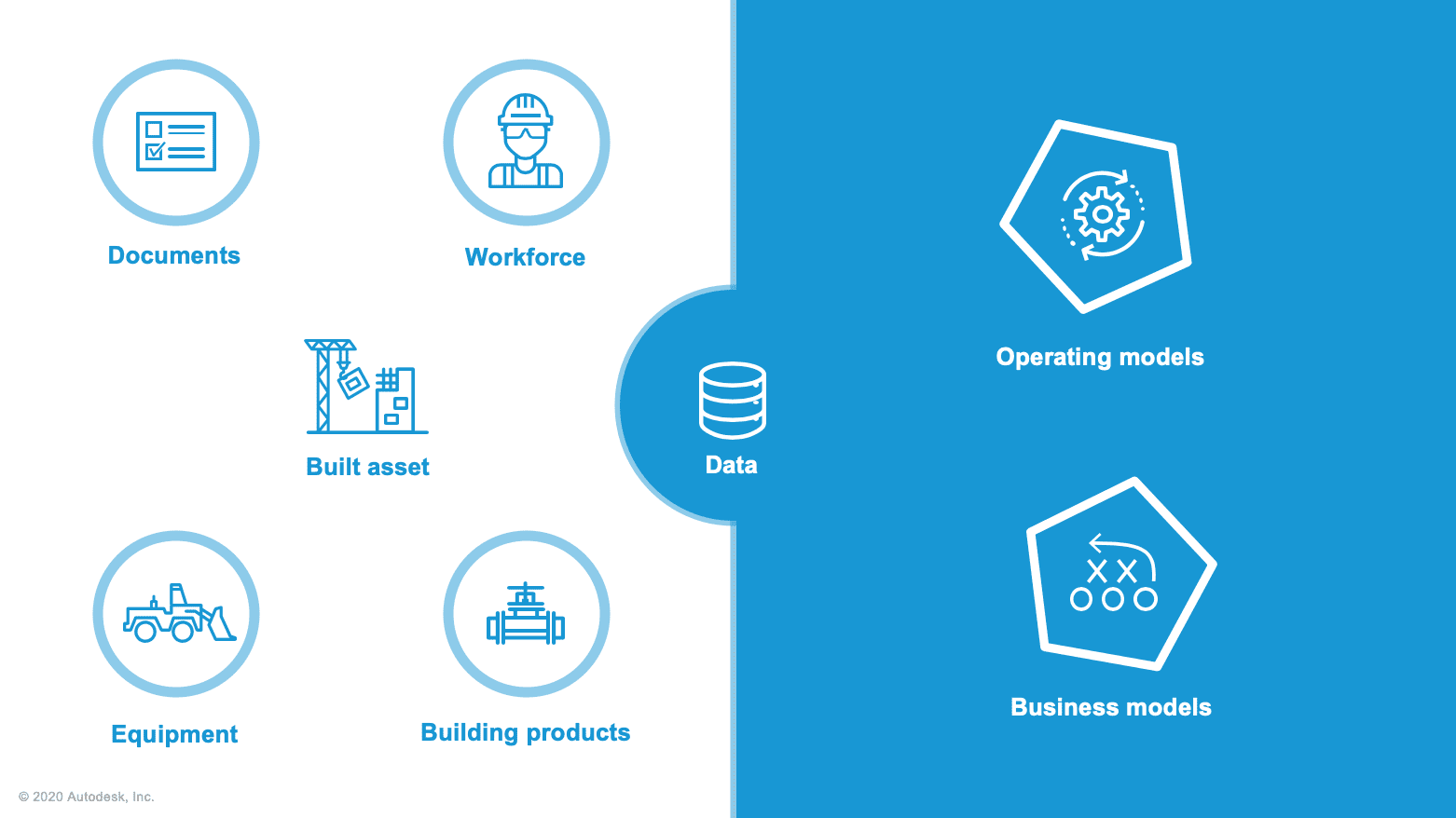

An overhaul is needed, if not long overdue, for companies seeking to create necessary conditions for change. Echoing the previous statements and stories of proactive mitigation and tweaks, we must also look at changes to the fundamentals of altering a business model. With the massive flow of information in present society, a digital transformation would mean putting data as the “basis” of a multi-faceted approach targeting the designing, planning, managing, and delivering of projects.

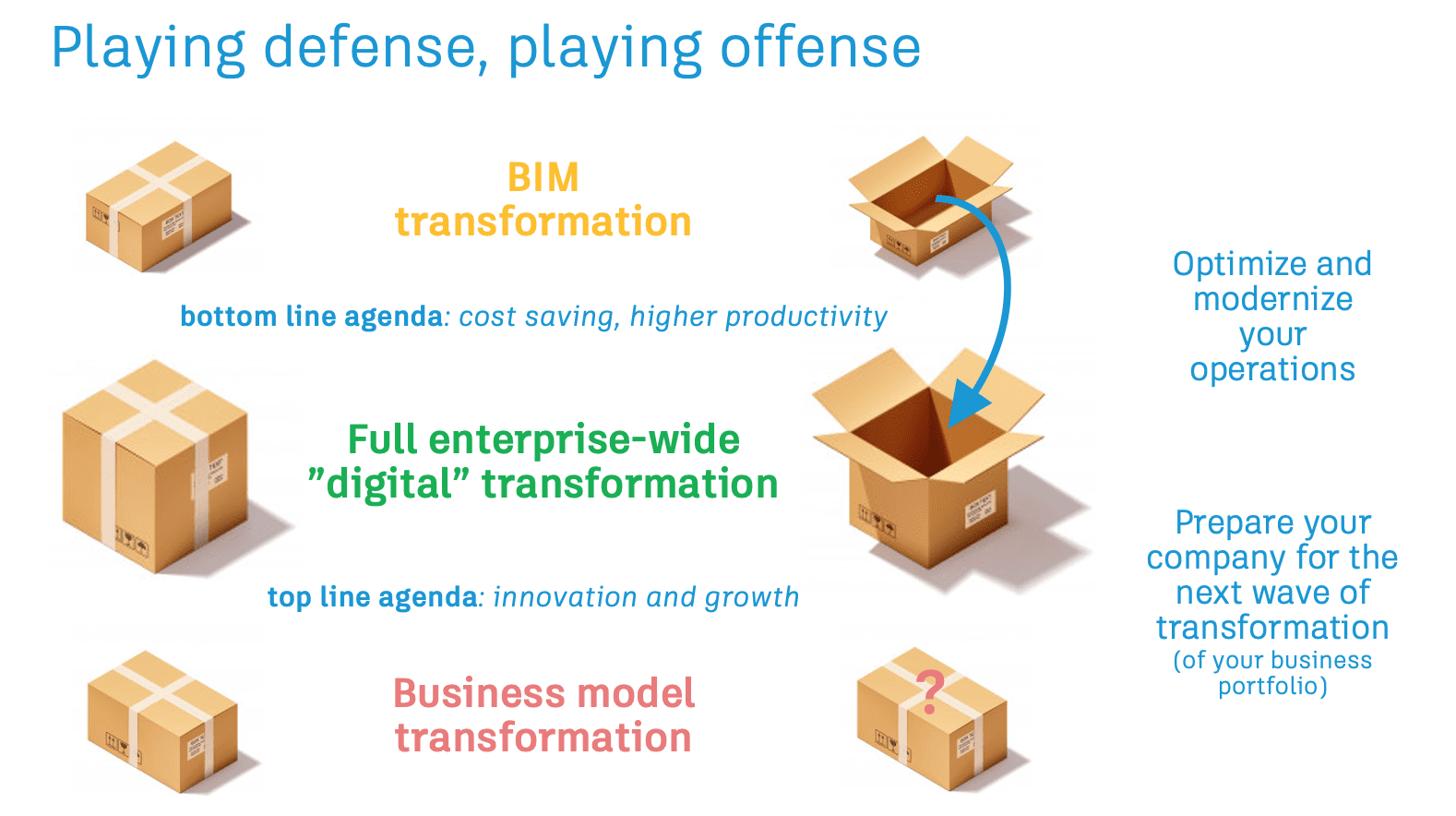

However, the key to success in a “data-centric” approach needs to not just focus on a company’s bottom line efficiency (optimization and modernization of operations, cost-saving, higher productivity), but also the top-line: increased growth, radical innovation, and the transformation of the business portfolio. Grasping on to old and familiar ways prevents change and transformation even if it may be currently easier and less costly than to transition. Most companies want to become data companies. They know they need to come up with fundamentally new business models to survive in the long-run. But most of them do not succeed in doing so. They either lack a good overall strategy to integrate the new and the old or fail throughout the transformation process.

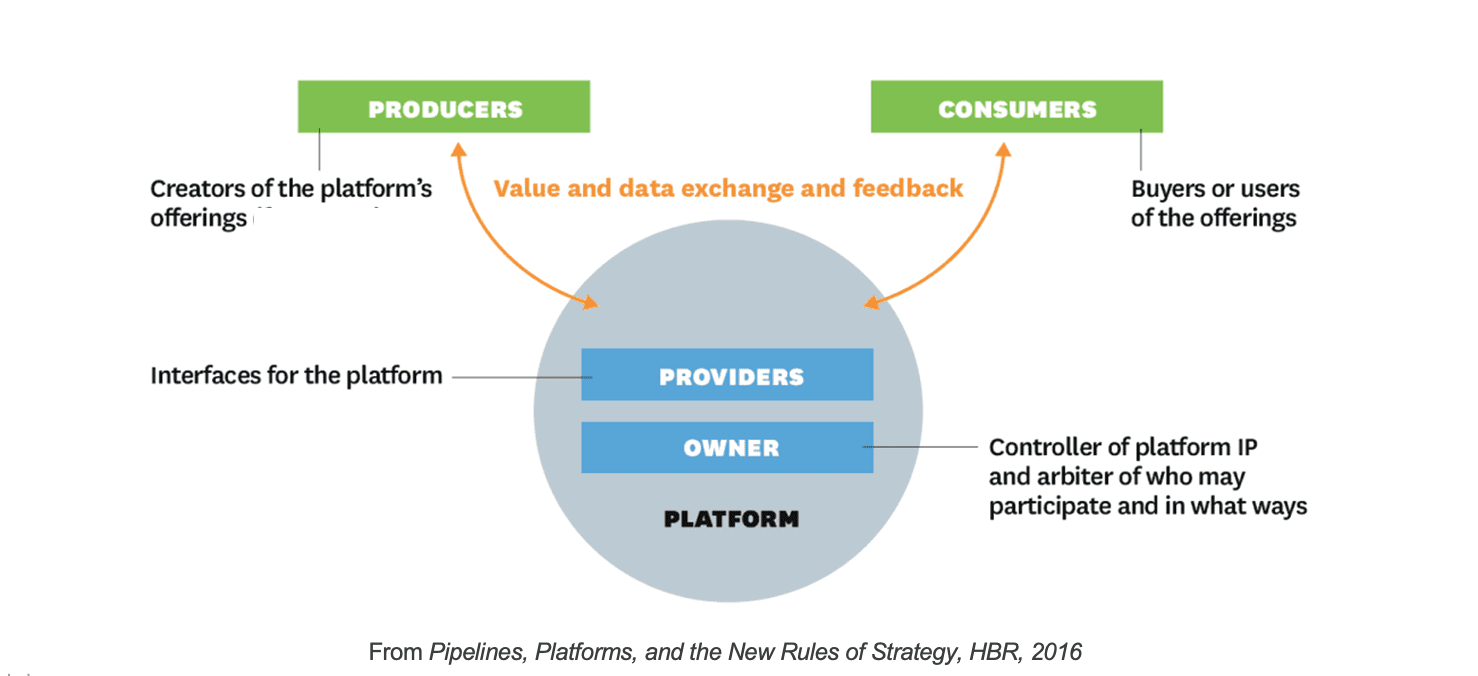

The whole Architecture, Engineering, Construction, and Operation (AECO) industry may turn towards Platform Business Models. The traditional construction model of a sequential/pipeline business model (focused on controlling and vetting the clients and the suppliers) could very well be phased out in favor of a Platform Business Model (orchestrating resources, selling services to the whole ecosystem, leveraging a network). With difficulties in staying ahead of the competition, grow, and maintain their margins, most of the largest AECO firms look at Platform Business Models with envy. Yet, the transformation of a Business Model is a long journey, and not all AECO firms are agile enough and have the investment capabilities to pivot toward new models.

In recent times, a growing number of companies are seeing the potential benefits of adopting digital platforms across project lifecycles. Fewer spent resources and less generated waste can drive down costs and expenses. Better quality, greater trackability, and predictability can improve the trust relationship between clientele and the company while upholding if not also uplifting industry standards of accountability. Greater productivity, increased collaboration, and better management of built assets hallmarks of increased efficiency, all allow the company to tackle even more projects within the same span of time.

However, when it comes to Platform Business Models, changes also bring questions just as much as it may bring gains. Since Data is a valuable asset, who will own it? Who will become the Main Data Contractor? Who will be the providers of the platforms, who will be the producers of the offerings, who will be the Consumers of the services, who will be the Owners of these Platforms, and who will control the IP?

One of the leading examples of Platform Business Models would be Skanska, a Swedish based contractor and one of the world’s largest construction companies. At the other end of its partnership, is IKEA. The two companies are in an agreement that Skanska will build and install prefabricated homes using modular construction practices favored in some Nordic areas. This entails that a consumer can simply walk into an IKEA store, pick out their home from a wide selection of components, to which Skanska will deliver it and build for the consumer at the designated place. That type of business model melds IKEA’s existing power as a direct-to-consumer modular furniture producer, and Skanska’s strength as a leader in construction and development into a composite that is stronger than the sum of its parts.

In order to avoid commoditization, integrating value-added services, real estate development, and even design and fabrication shops to streamline delivery, are some of the new practices adopted by some construction companies. The most advanced ones launch strategic initiatives related to Industrialized Construction and Design for Manufacturing and Assembly (DfMA). These firms have developed their own prefabrication delivery capability and embrace modular construction. Companies such as Boldt, Clark, DPR, Mortenson, Balfour Beatty, BAM, Mace, and NCC are examples here. They manage these new businesses in various ways, sometimes through subsidiaries or spin-offs. Industrialized Construction is the beginning of a radical transformation journey for these firms.

Other players create their own data platforms and try to create new ecosystems around them. They partner with technology companies, build tailor-made solutions, develop new service offerings, and conceive new business models to deliver and capture value. They try to move up the ladder, from asset builders and service providers to technology creators and network orchestrators. Companies like Bechtel, Bouygues, Daiwa House, Ferrovial, Kajima, Larsen & Toubro, Lendlease, Takenaka, and VINCI have all launched strategic initiatives in this direction. Some of these large players already manage several business models. In their case, the challenge is to diversify even more and to build synergies between the old and the new.

For other large companies, adjacent to the AEC industry, the pivot of their business and their transformation is already underway. Caterpillar, ISS, Jones Lang LaSalle, Kone, LafargeHolcim, Saint-Gobain, Schneider Electric, Wienerberger are examples here. Across the globe, mid-size and large engineering firms (AECOM, Arcadis, Fluor, Jacobs, WSP…) are also attempting to pivot and develop new business models to grow differently. In addition, the largest and most innovative design and architectural firms try to reinvent themselves: offer new services and build new business models to support them.

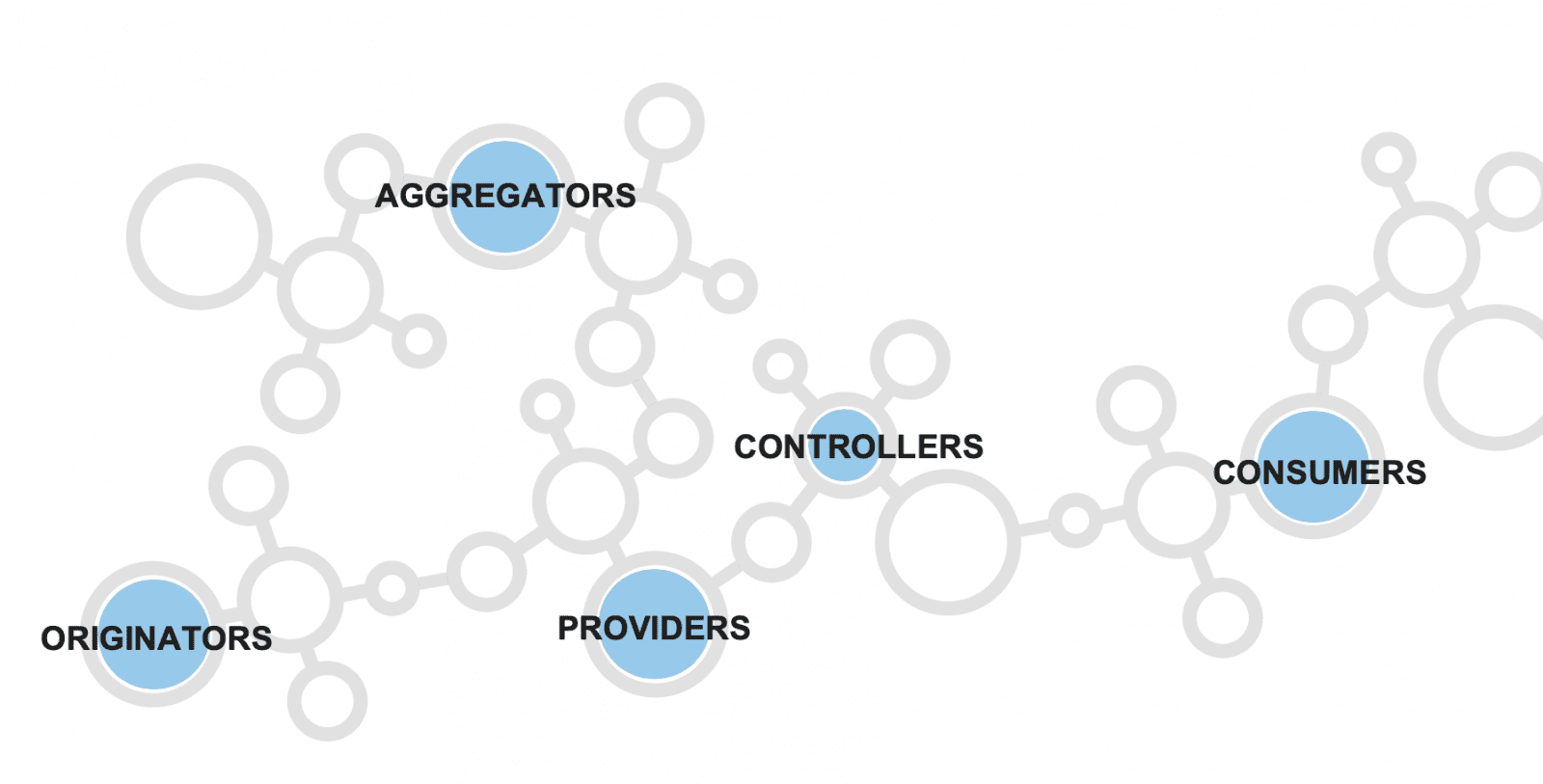

Platform Business Model attracts companies because it is considered by all technology and business experts as the most valuable type of business model. But it is still difficult to predict what is going to happen. Business models scale differently, and network orchestrators grow revenues faster, generate higher profit margins, and use assets more efficiently than companies using the other three business models. In many ways, network orchestrators operate in ways that run counter to what we’re used to thinking of as the best practices of other business models. For an incumbent firm, it is a journey. During this long transition, roles and boundaries are changing and becoming blurry. What is certain is that Data is the new raw material, fueling the dramatic ecosystem shift taking place. All players will create and also consume Data. In the future, firms will buy, sell, and trade Data. There will be Data Miners, Data Controllers, Data Brokers, Data Wholesalers, etc.

At an industry level, expect to see the emergence of new types of players and ecosystems:

Planners, land developers, designers, engineers, builders, and facility managers will still exist in the future. These five new categories are just new ways to look at the industry from the point of view of the data. Designers, engineers, and builders will still have plenty of work to do in the future. If we come together to capture, sort, and clean the structured and unstructured data of our industry, there will be increased benefits for everyone.

While business transformation is needed to sustain the future of the AECO industry, firms still need to adjust their strategy to address immediate concerns. According to an EY report on business disruption, this can be achieved by embracing duality, “As a result, strategy can be neither long-term nor short-term; an organization’s strategy must encompass both, and the interactions in between.”

With Digital Transformation comes a new era of data and cultural reinvention that will be the answers to the technological aspect of the transition. For this matter, culture is as important as technology, and for any firm, a strong and agile culture is a competitive advantage. Construction tends to be a late adopter to change, and for the AECO industry, this new wave of transformation is also a cultural one. For these firms, moving to more data centricity is an immense cultural challenge. “The way things are done,” behaviours, beliefs, customs, attitudes, given ideas, feelings, perceptions, emotions are disrupted.

At Autodesk, we are convinced that firms need to be more intentional about their Digital Transformation. We want our clients to make better decisions about their future. A special program called the “Arc of Transformation” has been set up to manage these strategic plans. It helps clients prepare and develop their out-of-the-ordinary initiatives, with new mindsets and new behaviors. With this method, they can improve in three domains: the activation of their data, the improvement of their performance, and the orchestration of their network. In order to go beyond heroics, a focus is placed on the cultural aspect of transformation. We believe this is one of the missing pieces of the puzzle. A lot of initiatives fail because this domain is underestimated. While working with clients, we use the Originator – Provider – Aggregator – Controller – Consumer framework to help them formulate their strategic orientation towards new roles and responsibilities. It changes our client’s perceptions of themselves. We have also defined frameworks to kickstart our clients’ business transformation. It guides them to set the right priorities, establish a solid program, and quickly achieve business outcomes. This allows us to assess their business by establishing their strategic profile, a business model health check, and using predefined initiatives and capabilities frameworks. The next step is our Industry Outcomes offerings catalog to quickly achieve business benefits and bridge the gap between innovation and business.

The change in how a construction company operates, or how the industry operates, is not a simple change that can happen overnight. It’s a crucial shift that is of paramount importance, which will commence at every level. From marketing to management, laborers to leadership, companies to consumers, a rethink of strategy, and embracing duality is at hand.

As venture capitalist Marc Andreessen stated in his influential essay, “It’s time to build”: “Part of the problem is clearly foresight, a failure of imagination. But the other part of the problem is what we didn’t *do* in advance, and what we are failing to do now”. To this respect, we see in our client’s organizations the emergence of new roles (i.e., Chief Data Officer, Chief Digital Officer, Chief Transformation Officer, Chief Analytics Officer, Chief Partnership Officer), new activities (that focus on data capture and usage), and new tools (to make business decisions and to develop insights based on data). Companies are forging new relationships with technology companies, shifting their collaboration from purchaser/vendor to becoming partners. We believe this is only the beginning.

As COVID-19 passes, so too will our previous trends and habits of the workplace and industry as we change and adapt. Here are some resources that may help you.

There is no obligation for you to agree with or embrace the topics exposed in this article. I would like you to finish it being able to apply the ideas directly to your own culture for immediate effect. If you’d like to engage in an in-depth discussion on how business transformation in construction can help firms wade uncertainty, let’s discuss. Contact me on LinkedIn.

I will present this vision in more detail during a virtual session at Autodesk University 2020. It can be found in the Industry Talk section. It is called “New Business Models and Business Model Transformation in Construction 4.0” (#CS464709).

May we collect and use your data?

Learn more about the Third Party Services we use and our Privacy Statement.May we collect and use your data to tailor your experience?

Explore the benefits of a customized experience by managing your privacy settings for this site or visit our Privacy Statement to learn more about your options.