Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

More than six months into the COVID-19 crisis, the pandemic’s effects are still reverberating across the construction industry. Projects have been disrupted, scrapped or delayed, and safety is an even more dominant concern than in any other year.

Undeniably, the construction industry is still learning how to grapple with the changes and consequences of the pandemic. The findings of the new 2020 Autodesk and AGC of America Workforce Survey highlight the extent of the impact with insights on labor demand, innovation and technology adoption, and more. More positively, the report also reveals some bright spots and provides a glimpse into the construction industry’s path to recovery.

Here’s an overview of the survey’s key takeaways on how firms are doing in this unprecedented era, and what’s in store for construction in the year ahead.

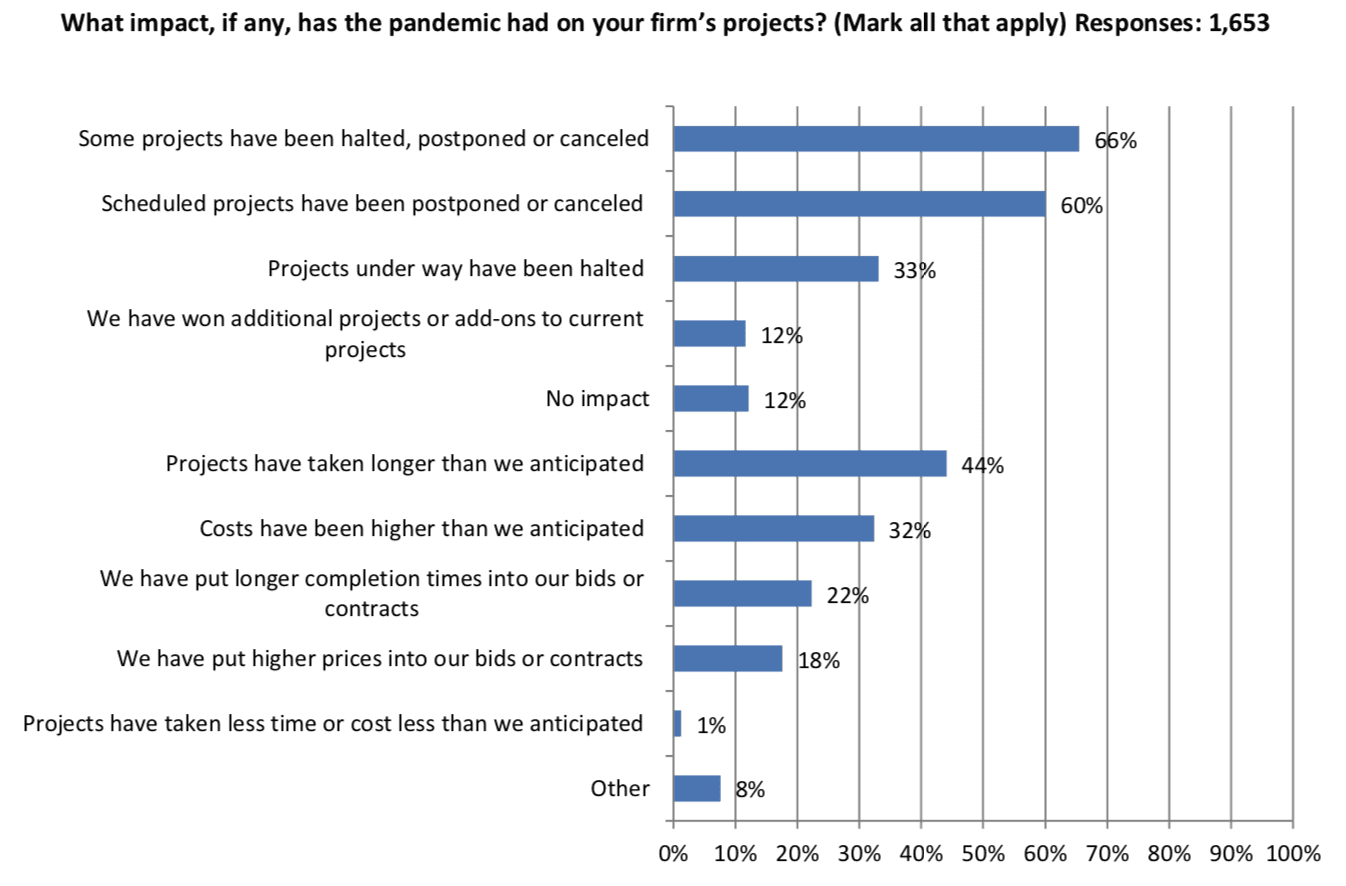

It’s still much too early to determine the long-term effects of the COVID-19 crisis on the construction industry, but the 2020 Autodesk and AGC of America Workforce Survey provides some insight into the short term impact of the pandemic. Namely, COVID-19 has mostly affected schedules and costs for construction projects, with 60% of projects being postponed or canceled, 44% of projects taking longer than expected to complete, and 32% of projects having costs run higher than projected.

There have also been implications for construction firms’ volume of business. As fewer projects break ground, many in the industry believe it will take quite some time for business to return to 2019 levels. Specifically, 38% of firms surveyed said they believe it will take more than six months for their volume of business to reach a similar level relative to one year ago. Simultaneously, nearly one third (29%) of firms reported that their business volume has remained the same or greater than last year.

Regardless, the vast majority – 89% -- of survey respondents indicated they think some form of government action is necessary to drive economic recovery, with only 11% saying that no additional legislation is needed. As for what kind of government intervention would be beneficial to the construction industry, 55% agreed a larger federal investment in all forms of public infrastructure and facilities would be helpful to their business.

Additionally, the majority of construction firms surveyed stated they would like government protections to help them deal with any legal action stemming from the safety concerns brought on by the COVID-19 pandemic, and ensure that their efforts to address these issues are acknowledged. Particularly, more than half (53%) believe a “safe harbor” set of government-issued protocols are needed to protect firms from tort or employment liability for failing to prevent a COVID-19 outbreak.

One measure of the construction industry’s strength is the level of demand for labor. The new Autodesk and AGC survey found that the pandemic has had little impact on labor demand in recent months. One half of all firms surveyed reported no change in headcount as a result of the COVID-19 crisis, and in fact, nearly a quarter (23%) of firms have added employees during the pandemic.

What’s more, 32% of firms reported no change in headcount year over year, and 27% said that headcount had increased in the same time period. Still, 41% of firms reported a decrease in headcount since 2019.

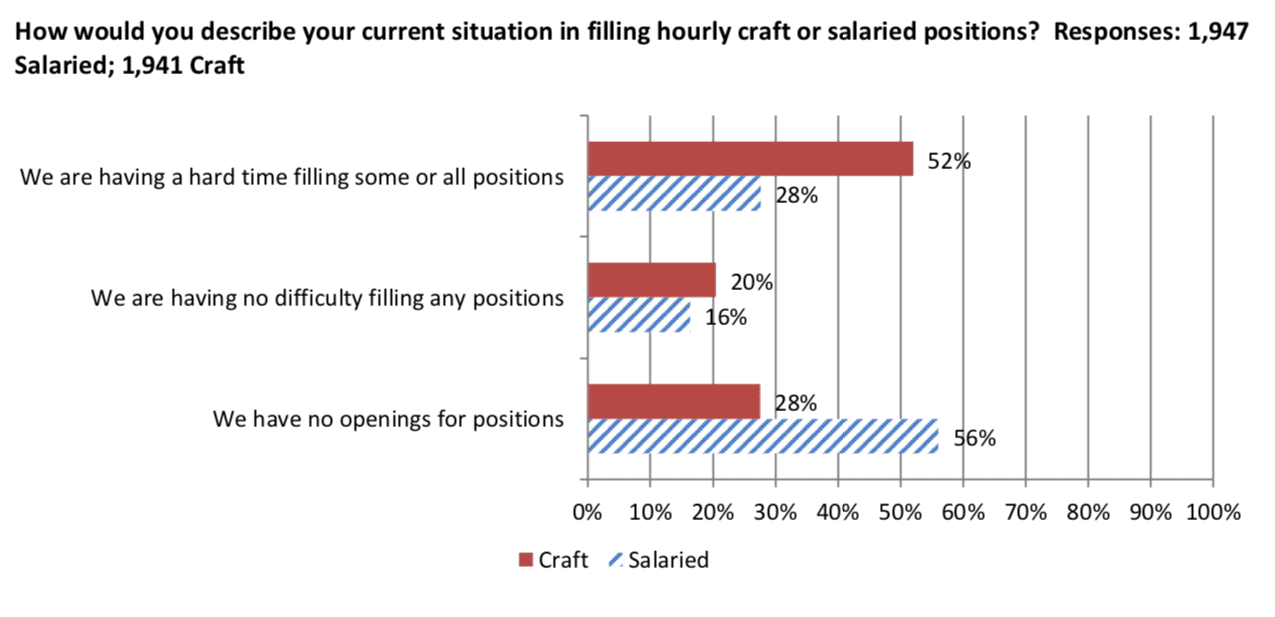

Other survey findings indicate that demand for labor in the industry remains strong. When it comes to employee furloughs, two in three (68%) construction firms said they didn’t have to take such measures, and 38% actually reported increasing base pay rates. And regarding openings for salaried employees, 56% of firms said they have no openings for these roles, and 28% reported having difficulty filling these positions. Specifically, 81% of respondents said that they are having trouble hiring project managers and supervisors.

More measurably, a majority of firms (52%) reported encountering difficulties in hiring hourly craft workers. But similar to salaried positions, 28% of firms said they have no open positions for hourly craft positions, up nearly 300% from last year, when only 9% of firms reported having no openings for hourly craft positions.

This year, firms reported the top positions they’re having a hard time filling included laborers (43%), carpenters (35%), and crane/heavy equipment operators (29%). But in spite of these difficulties, 38% of firms expect to add new employees in the next 12 months, a strong sign that labor demand will increase, and a recovery is in sight for the construction industry.

Despite the issues and setbacks brought on by the COVID-19 crisis, the construction industry remains firmly committed to moving forward through innovation and technological evolution, the 2020 survey shows. Increasingly, firms are embracing the integral roles of technology and data in the construction industry’s future.

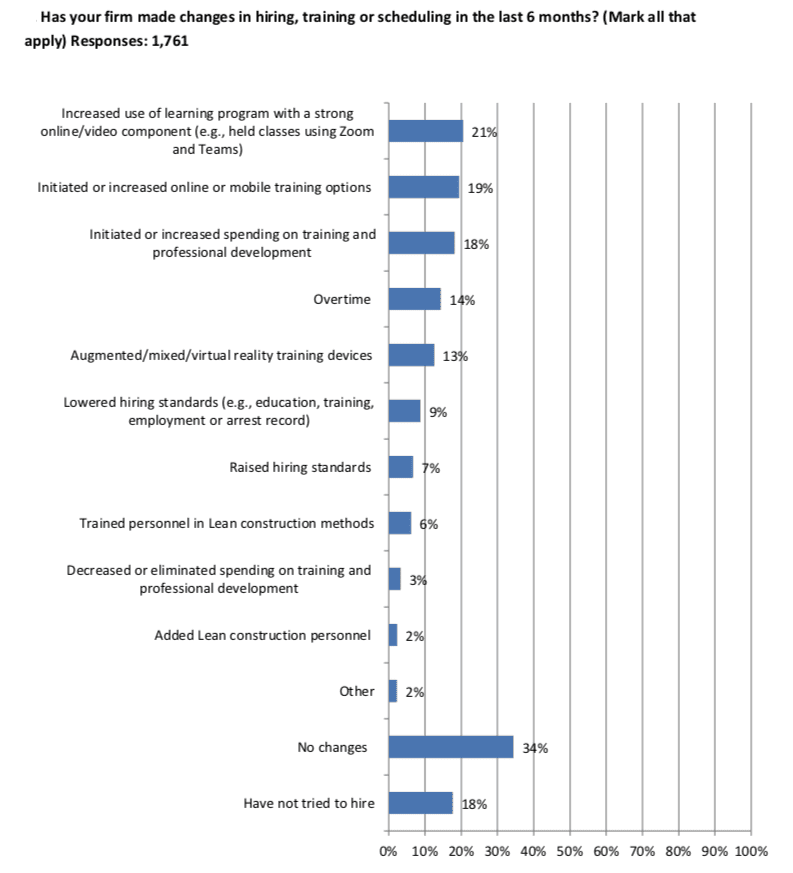

In particular, the industry is pursuing mobile and online training options in earnest, with 21% of firms increasing the use of learning programs that include a strong online/video component (e.g., classes held using Zoom, Microsoft Teams, and other platforms). Additionally, 19% of firms surveyed said that they had initiated or increased online or mobile training options, and 18% reported that they had initiated or increased spending on training development. Just 3% of construction firms stated they had decreased or eliminated spending on this front.

Construction firms are also innovating to address the labor shortage, the survey found. In fact, nearly 40% of respondents said they are implementing new technology to alleviate the shortage, including tools to improve project management (16%), field collaboration (13%), estimating (13%), workforce management (10%), and bidding (9%) at their firms. By embracing digital solutions, firms are more likely to achieve both time and cost savings, mitigating the overall business impact of both the shortage and pandemic.

Indeed, as technology continues to improve efficiency in the construction industry, firms are beginning to see the benefits of a lean approach to projects. While only 6% of respondents said they had increased or adopted lean construction methods, the survey also provided insight into the effectiveness of this model. Notably, firms that reported they had worked on High Lean Intensity (HLI) projects in the last year shared that a vast majority of recently completed projects were on or ahead of schedule (83%) and within or under budget (82%).

More than any particular finding, construction firms’ collective response to the 2020 Autodesk and AGC of America Workforce Survey most emphatically highlights the industry’s resiliency in a year of massive challenges. No doubt projects are being impacted in a significant way. But with the demand for labor remaining strong and more firms embracing technology and innovation to improve efficiency, this year’s survey indicates that the industry is likely to recover, despite the tremendous impact of the pandemic.

Still, recovery, like many other areas of construction industry growth in recent years, is dependent on firms’ willingness to support their workforce, and embrace new technologies. The survey shows that this is happening in the construction industry in the form of online training and educational programs, as well as the use of technology and lean project approaches that are proving to be both efficient and cost effective.

The focus on innovation and resilient spirit evident in this year’s survey responses suggest that the construction industry’s future looks bright.

Read the full report, here.

May we collect and use your data?

Learn more about the Third Party Services we use and our Privacy Statement.May we collect and use your data to tailor your experience?

Explore the benefits of a customized experience by managing your privacy settings for this site or visit our Privacy Statement to learn more about your options.