Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

Help us improve your experience. See content that is made for you!

See how IBM increased their efficiency by up to 30%!

Just as 2020 was a pivotal year for construction, 2021 is shaping up to be monumental for the industry. More than ever, specialty contractors are facing increased risk, opportunity, and competition, raising the stakes on staying ahead of key insights and trends.

To help you keep up with industry trends and insights affecting subcontractors, we developed a special edition of the 2021 Autodesk Construction Outlook: Risk & Opportunities report for specialty contractors. The report combines external economic data from sources such as Dodge Data & Analytics with Autodesk’s own aggregated, anonymized BuildingConnected product data to uncover the evolving state of the industry.

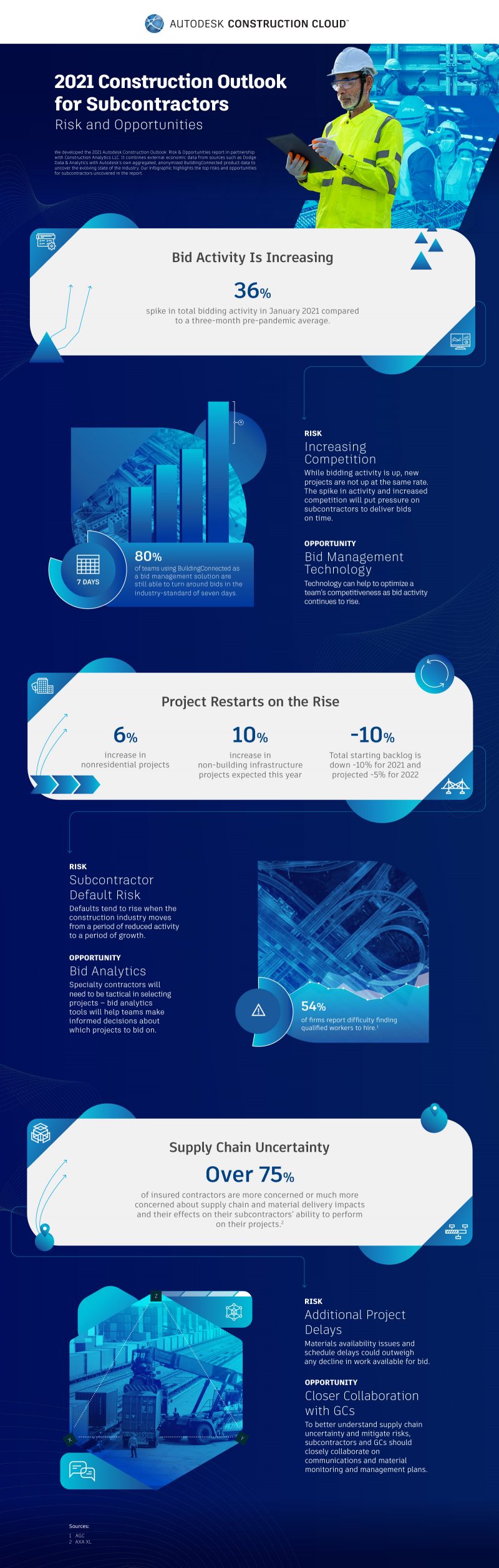

To highlight the top risks and opportunities for subcontractors uncovered in the report, we also created an infographic. Read on and view the infographic for valuable insights and key takeaways from the report. View full size infographic here.

Commercial bidding activity has now surpassed pre-pandemic levels revealing a surge of opportunities on the horizon for subcontractors. There was a 36% spike in total bidding activity in January 2021 compared to a three-month pre-pandemic average when analyzing BuildingConnected data. Further, January 2021 bidding activity volume on BuildingConnected represented an all-time high on the platform. The volume of projects added to the BuildingConnected platform and the volume of bid invitations have increased, which may be the result of restarts of delayed or rescheduled projects.

However, while bidding activity is up this year, the number of new projects is not keeping pace. With more bidding activity on fewer projects, subcontractors will need to be more competitive than ever. The spike in bidding activity and resulting increase in competition will put pressure on subcontractors to deliver bids on time and be more selective regarding the bid invitations they pursue.

In addition to time pressure and greater selectivity, more bidding activity also necessitates a greater emphasis on accuracy and transparency. The focus should be on optimizing bids to win projects with the highest profitability potential. This is where bid management technology can play a valuable role. In fact, 80% of the more than one million professionals using BuildingConnected as a bid management solution are still able to turn around comprehensive bids in the industry standard of seven days. This solves for increased time management pressure and optimizes a team’s competitiveness as bid activity continues to rise.

The construction industry expects to see a 6% increase in nonresidential projects and a 10% increase in non-building infrastructure projects this year. Moreover, the total starting backlog is down 10% for 2021, and is projected to be down 5% for 2022.

Defaults tend to rise when the construction industry moves from a period of reduced activity to a period of growth, especially in a short time period. This is largely related to the industry-wide labor shortage, with 52% of construction firms reporting difficulty finding qualified hourly craft workers to hire according to data from the Associated General Contractors of America (AGC). Lost time spent searching for labor can set projects back, forcing subcontractors into overtime, leading to losses in productivity and profitability.

Specialty contractors will need to be strategic when it comes to project selection. Bid analytics tools will help teams make informed decisions about which projects to bid on, and which opportunities play to their strengths. In 2021, quality will be king when it comes to bid selection, and bid analytics tools can help subcontractors pursue the bids with the highest potential for profitability, all while setting them up for success by optimizing their bids for accuracy, transparency, and timeliness.

The pandemic upended many things about the last year, but one of the most affected parts of the construction world was the supply chain.There was a surge in supply chain uncertainty in 2020 that has carried over to this year. In the wake of COVID-19, more than 75% of insured contractors are more concerned or much more concerned about supply chain and material delivery impacts and their effects on subcontractors’ ability to perform on projects, according to AXA XL research. Additionally, there are elevated concerns on an enterprise level regarding supply chain issues.

As numerous projects have been halted or disrupted, delays are causing weeks-long setbacks and place new additional pressure on subcontractors. Firms that manufacture many goods used in construction were temporarily closed during the pandemic, which disrupted production and caused supply chain delays. Material availability issues and schedule delays could outweigh any decline in work available for bid.

To better understand supply chain uncertainty and mitigate risks, subcontractors and GCs should closely collaborate on communications and material monitoring and management plans. An important part of building out these plans involves putting a point person or committee in charge of supply chain risk mitigation efforts. Subcontractors and GCs also have the opportunity to collaborate on creating strategies for clear and consistent communication, as well conducting a supply chain audit and implementing a materials tracking program.

Download the 2021 Autodesk Construction Outlook: Risk & Opportunities report for even more industry trends and insights.

May we collect and use your data?

Learn more about the Third Party Services we use and our Privacy Statement.May we collect and use your data to tailor your experience?

Explore the benefits of a customized experience by managing your privacy settings for this site or visit our Privacy Statement to learn more about your options.