As different regions across the globe start to open up for business in the wake of the COVID-19 pandemic, many of your peers have returned to their once-stalled projects. However, with return to work comes many questions about what the future holds for the construction industry. New ways of working have been implemented, both physically on the jobsite itself and digitally from team members’ home offices.

To help you prepare for the next few years as a construction business, Autodesk and FMI partnered on a recent webinar titled “Preparing for Tomorrow: The Post COVID-19 Recovery Outlook” to offer insight and advice on the big question: what comes next? It included identification of the markets and segments that will lead or lag over the next several years. More importantly, using research from the last recession and current economic benchmarks, we highlighted strategic lessons learned and mistakes to avoid in times of heightened uncertainty, including adapting to a reinvented built environment.

If you don’t have time to watch the recording, we’ve highlighted some of the key insights related to construction recovery and returning to better below. Furthermore, if you’re seeking advice on how to restart your projects, we covered that in our first COVID-related webinar and you can find that information here.

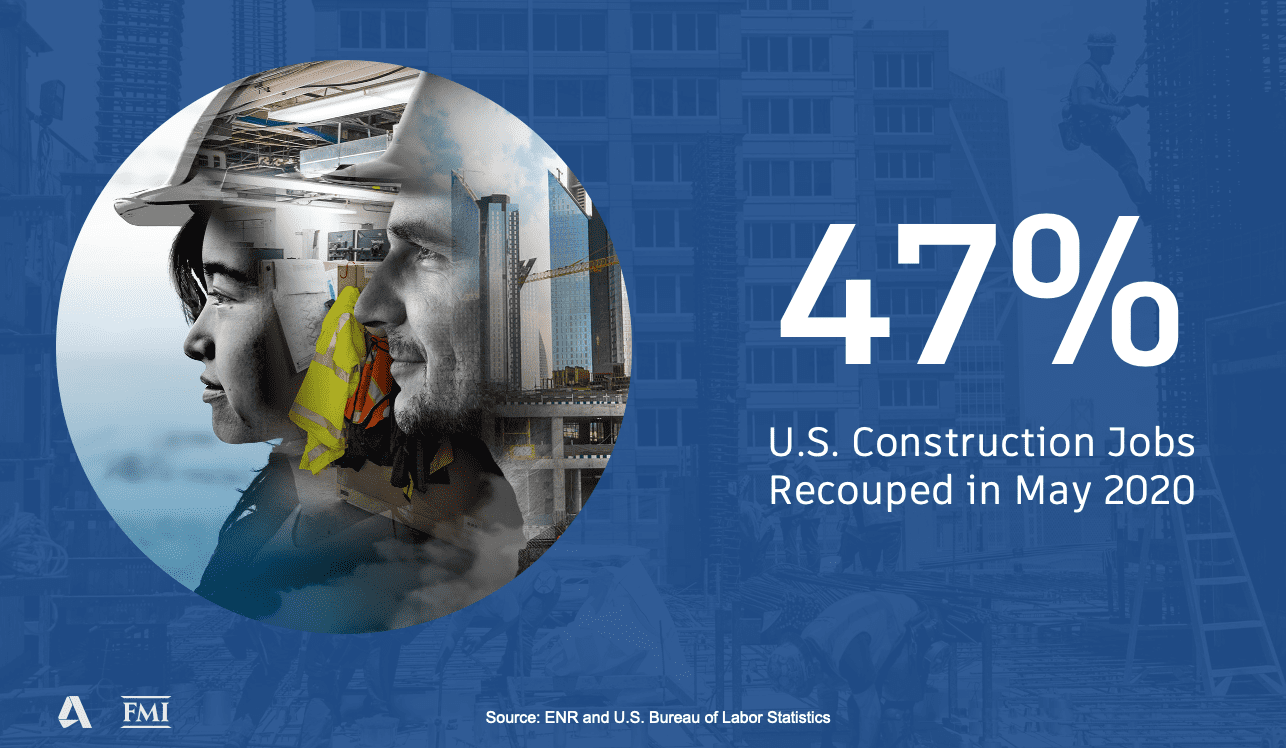

When we last discussed COVID-19 with FMI in early May, many construction firms had to lay off or furlough a great number of employees in response to restrictions placed due to the pandemic. In that webinar, we polled attendees--and while the spread of responses related to project stoppages varied-- 69% of attendees reported that half or more of their projects stopped. Since then, the latest jobs report from the U.S. Bureau of Labor Statistics indicated that the construction industry added 464,000 jobs during the month of May, which shakes out to a job recoup of about 47%. While this is encouraging to see, there is still a lot of work to be done to fully return to pre-COVID working capacity.

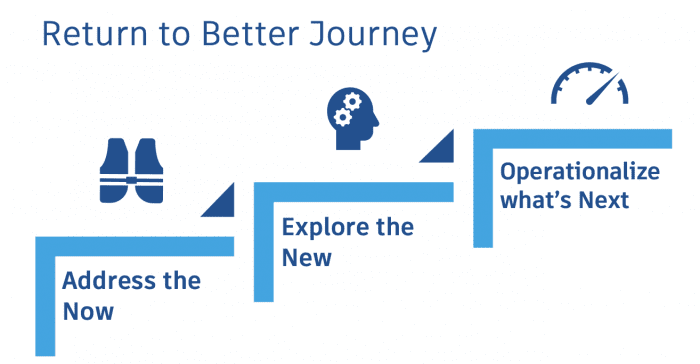

Allison Scott, Director, Construction Thought Leadership at Autodesk elaborated upon the “return to better” when she said, “Anecdotally, myself and others at Autodesk have been having a lot of discussions with construction teams across the country. The return to better journey has stretched drastically from thinking about the now, exploring the new, or preparing for the next.” She defined these states of the industry as:

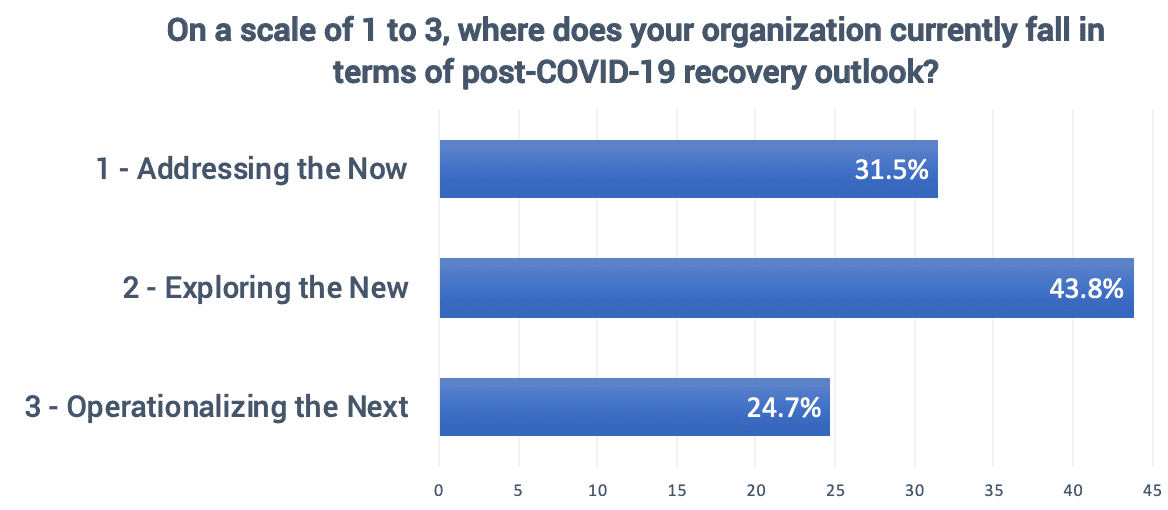

Allison polled webinar attendees, asking where they fell on the spectrum of the now, new, and next. The spread of responses may be due to the regional nature of project stoppages, as not all construction teams across the world are at the same stage of restarting.

Allison elaborated further on the return to better when she said, “An underlying component of these return to better trends are two big factors--the increased use of technology and the exploration of new business models.” She shared some metrics that showcase this, including Zoom’s recent report that stated their daily meeting participants soared from 10 million in December 2019 to 300 million in April 2020, which is an astounding 3000% growth.

At Autodesk, we’ve also seen substantial increases in the use of our digital platforms. For example, the rate of new project creation in BIM 360 Design jumped approximately 350% globally since working conditions shifted from the office to a work-from-home environment in mid-February.

“Anecdotally, we see examples in the industry of teams shifting quickly to virtual collaboration tools across the board, from increasing the use of project management tools for field execution tasks with tools like BIM 360 and PlanGrid to moving bidding and procurement online with tools like BuildingConnected.”

We’ve found compelling evidence from the last recession indicating that the investment in new technology and new processes increased exponentially. Additionally, the 2012 Smart Market report showed that the implementation of building information modeling (BIM) across the AEC industry grew from 28% in 2007 to 70% in 2012.

Allison elaborated on her own experience with technology during the last recession when she said, “Personally, I had a significant number of friends and colleagues laid off during the last recession. At the time, many of those people invested in learning tools like Revit or processes like BIM/VDC management. Those folks were some of the first rehired in the market once things started to pick back up.”

“Companies that invested more in tech during the downturn outpaced – and out-thrived – those who got ultra-conservative and limited technology spending. Adding the right technology at the right times, means firms won’t be scrambling to bring back talent or to scale operations to take on something new.”

-Travis Voss, Technology Innovation Leader, Mechanical Inc.

It’s also worth looking at how firms are exploring new business models and opportunities as COVID-19 sheds light on industry challenges like workforce development, supply chain, and data management. Examples we’ve seen of shifts in the market and business model innovation include:

Market Sector Growth/Contraction – Changes in the market sectors themselves, whether it’s growth, contractration or being reimagined completely (like retail and distribution), are forcing firms to rethink specialization and how they pivot their skillsets. This can lead to new market sector opportunities, new service ideas, and overall new opportunities for firms.

Vertical Integration and Mergers/Acquisitions – We saw this during the last recession and all signs point to an increase in the near future. With firms seeking to go more upstream or downstream in their skill sets or offerings-- like adding a design team, or standing up a fabrication shop-- integration can create more control and opens more doors to support additional methods like industrialized construction..

Data and Analytics as a Core Competency – We saw a rapid rise of firms moving off paper and working in more digital tools in the last ten years. Now, firms have more data than ever; and we have seen a significant increase in firms taking advantage of this new information and creating more core competencies around data, analytics, and business intelligence.

Allison closed by stating, “I want to point to this notion from Andrew Wolstenholme of ‘never waste a good crisis,’ which is a term coined from the UK constructing excellence report from 2009. Over a decade ago this report called out that big business model shifts needed to happen to realize desired outcomes of improved safety, quality, communication, and cost in the construction industry. So these conversations about business transformation are not new, but the time is now.”

A few weeks ago in our project restart strategies webinar, you heard Gregg Schoppman, Principal, FMI discuss the critical nature of the project restart and strategies to consider during that process. Gregg explained that in order to secure the long term health of your business, teams need to be thinking about how to productively get back to work and mitigate the challenges of labor shortages, new supply chain issues, PPE availability, contractual challenges, and much more.

In this webinar, Jay Bowman (also a Principal at FMI) discussed the most probable construction recovery trajectories for the global construction industry, post-COVID-19. He identified the markets and segments that will lead or lag over the next several years and highlighted strategic lessons learned and mistakes to avoid in times of heightened uncertainty.

FMI has found that there is an unsurprising amount of uncertainty surrounding the market and the expectations of it. Jay Bowman explained, “If we look at the past recession, for example, the trajectory went down considerably, the velocity was exceedingly fast and the duration was very long, one of the longest periods of slow recovery that we've seen in the modern era. However, there are three important lessons that can be learned from past recessions and periods of heightened uncertainty.”

These lessons include:

The reason for construction historically lagging behind the overall economy by a year or more is due to most work (approximately two-thirds) already exists or is pre-funded. This often gives a false impression of market health and stability.

Consider how global GDP declined at some of the highest rates in the modern era in Q2 2020, including significant losses among both public and private project owners. Many governments expect to see a 20% decline in budgets for next year, with construction often being the first thing that is cut. Yet, projections for 2021 still suggest a strong construction recovery is coming and the good news is this recession should be brief, lasting one to two years in the industry.

When discussing what’s required during high states of uncertainty, it’s important to address multiple potential outcomes. If we use hurricanes on the gulf coast of the US as an example, it’s uncertain what strength a hurricane will be or where it will land. Even so, you can still track variables to get a better sense of the potential outcomes of the hurricane. This serves as a good illustration of how we should be considering contingency planning for multiple scenarios.

At a macro level, construction teams should be considering the GDP, consumer activity, industrial position, employment, and wage/salary growth. At a micro level it’s important to consider the infection rate, project suspension rates, cancellation rates, and funding rates.

In particular, tracking the following three variables will allow you to better understand the demand outlook:

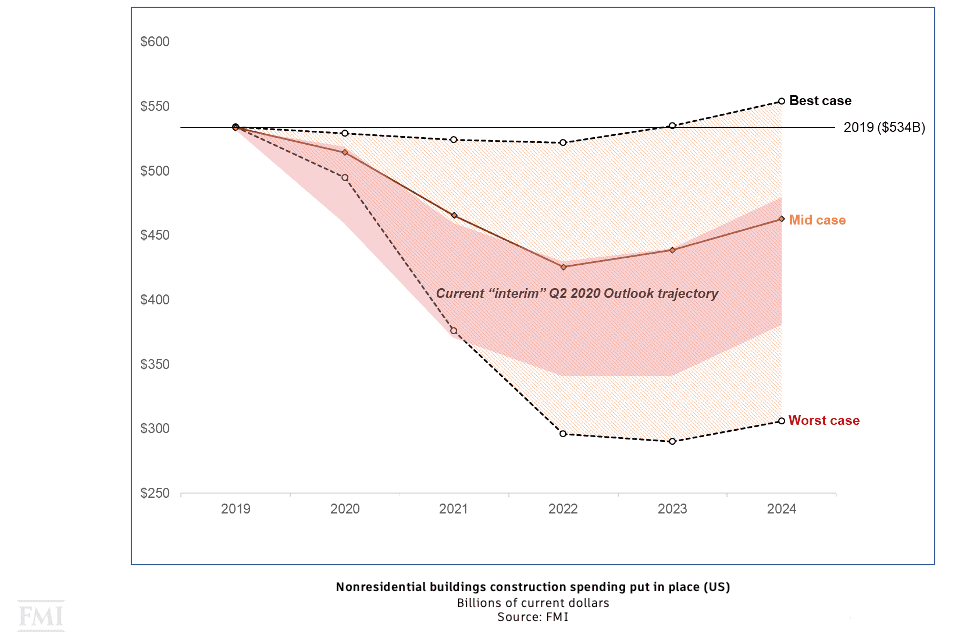

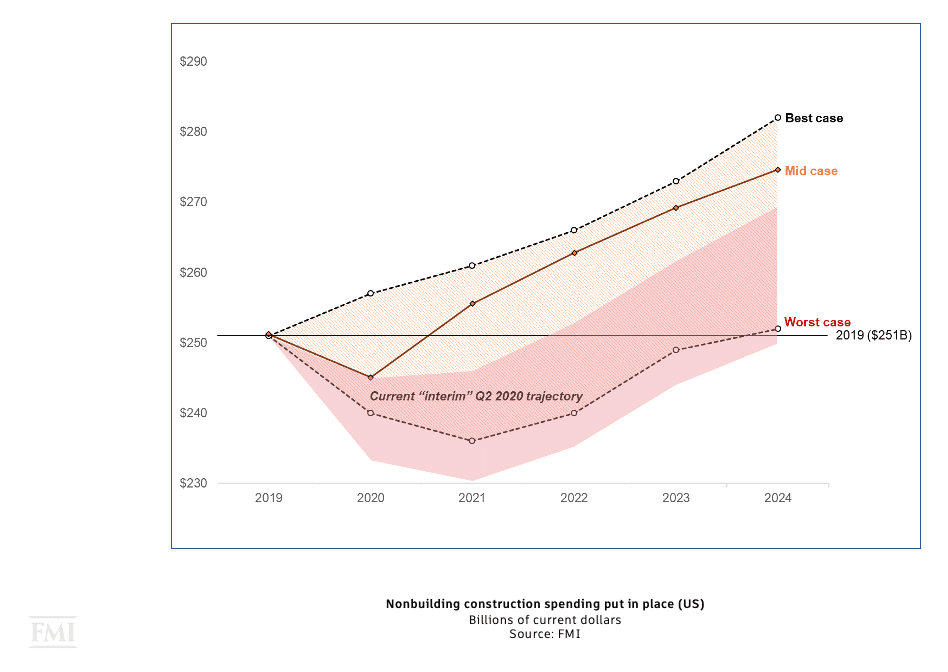

The chart below is the equivalent of a hurricane chart for the outlook of the nonresidential construction industry in the US. As you evaluate where you may fall within these three potential outcomes, questions to consider include:

Jay Bowman elaborated, “Currently, as we move into Q3, our early Q2 forecast trajectory is saying it's probably more along that mid case or belongs lower into that worst case level. So there are several assumptions that go into this which can vary widely. Even by the market, we can say that somewhere within 2021 or 2022 would represent the trough or the bottom of the current cycle that we're in for nonresidential building construction.”

If we take a more global lens and consider Australia and New Zealand, FMI projects that sometime during 2021 or 2022 total nonresidential building construction spending will be down roughly somewhere between 10% to 15%. More moderate declines will occur in North Africa, down around 5%. Declines will be more significant in North America and Western Europe, down 15% to 20%. In terms of the trajectory, the velocity is relatively quick, within a year to two years, but then possibly moving quickly back out of the declines.

Jay again reiterated that some sectors will be bullish, while others are bearish. He further explained, “Some [sectors] will be growing and some will be shrinking, but it does give a sense of overall activity. Similarly, if we look at non-building construction or infrastructure, think of these things like power, highways and streets, waterwater, conservation development activities, oil and gas, etc. Historically, we've seen that it's a much steadier sector overall in times of downturn. It doesn't experience the same highs, but neither does it necessarily expect the same lows.”

A key part of considering multiple outcome scenarios is avoiding poor decision making. One of the greatest lessons we learned in the last recession was that the majority of construction organizations did not make decisions quickly enough, even when their path was correct.

Jay further explained “We often see decision paralysis as more common among managers and organizations that are highly risk-averse. Decision paralysis is also influenced by the obsession with perfection in the data and information before a decision is made. As we know, the idea of data and information perfection is really a fool's errand, and as time goes by information quickly becomes outdated.”

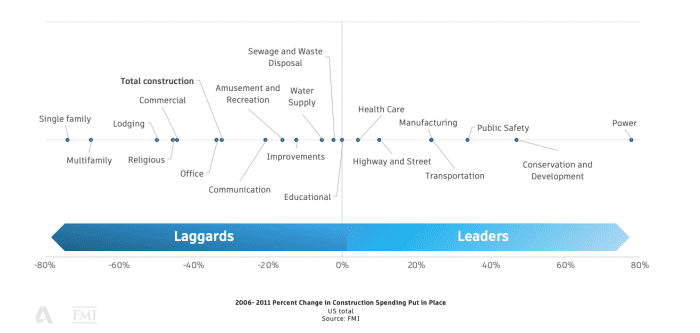

As stated earlier, bull markets and bear markets can coexist in the construction industry. Some sectors will be heavily impacted by recessions and/or COVID-19, while others are bolstered by the challenges we’re facing. “If we think of construction activity in North America, particularly in the US during the last great recession, peak to trough was between 2006 to 2011,” said Jay.

Over that five year period, total construction declined by almost 40%. As you can see in the chart below, the amount of decline varied widely across different segments. Single family construction was down almost 80% during that same time period whereas educational, sewage and waste disposal, and water supply were down, but only slightly.

The potential bull sectors will vary geographically, but one area will be manufacturing, particularly in the area of pharmaceutical and life sciences. This has some importance with the rush to create the vaccine, but it's even larger than that.

Next would be in the distribution space. eCommerce has benefited greatly from many of the stay at home orders resulting from COVID-19. Nevertheless, this was already starting to change as we reached smaller facilities and their ability to provide goods to more urban or densely populated areas. With the ability to do same-day delivery, grocery and food supplies are just as easily included in that chain as books or any other non-perishable good.

The third major bull sector would be in the communications and data center sectors. Jay explained, “It's not just the hyperscale data centers, which represents a majority of the growth that we've seen in data center construction over the last several years. When we talk about hyperscale, we're talking about million square feet plus facilities. But now it's even as we're moving into the smaller expansions and upgrades of existing data centers”

The fourth bull sector on the infrastructure side includes intelligent transportation systems. With the deployment of millions of sensors in preparation for autonomous vehicles, semi-autonomous vehicles, electronic tolling, and dynamic messaging systems. The underlying factor is how technology has really started to create the demand for these segments that is almost secondary to the economy.

Bears during this pandemic will line up closely with industries that are suffering the most while economies are shuttered and stay-at-home orders are in effect. This includes lodging, hospitality, commercial, amusement and recreation, and office workspaces. Jay Bowman indicated that one should look for opportunities within these bear markets as well.

“Even within these bear sectors, it's important to understand the amount of growth opportunities that actually do exist, sort of niche markets. Whether it's moving to touchless environments in an office setting, or even if it's the re-imagining of space to meet social distancing requirements, all of the renovation work that we'll begin to see in many of these bear sectors will actually prove to provide significant growth opportunities for those who are watching.”

As we begin to prepare for our industry’s return to better, it’s important to be ready for rapidly evolving dynamics both externally in the market and internal to each organization. Many of the external factors have been seen before during previous recessions, but many of the internal ones will be new as we learn to deliver projects under the umbrella of COVID-19. Lessons learned from the past recession to remember include:

Jay’s closing remarks framed the opportunity moving forward clearly when he said:

“This is not a time to panic. This is a time to prepare and prosper. Be ready to prepare and actually move towards whatever's next. Remember this, during the last recession, those companies that prepared for that downturn or even moved during that downturn, saw their earnings grow almost four times those that didn't.”

To learn more about how your team can start planning for project restarts, check out the following FMI and Autodesk resources: