Historically, construction has been one of the least digitalised industries in the world, but right now businesses in Europe are under pressure to adopt technology like never before.

Construction clients are demanding more communication during the build and ownership over project data. Businesses are keen to improve project productivity, which remains low in many countries.

Digital tools can help firms to adopt innovative approaches, whether it’s offsite manufacturing during construction or smart building technology for facilities management. And recent experiences have proven how valuable these digital platforms can be for maintaining business continuity during disruption, such as the COVID-19 outbreak.

But where are European construction businesses up to with digital transformation – and how does that compare to firms worldwide? To get insight Autodesk engaged IDC Research who surveyed 835 construction professionals worldwide to explore the Future of Connected Construction.

Construction businesses around the world appreciate the benefits that digital transformation can bring, starting with project performance. One in five say that the top benefit of digital construction solutions is overall project management and performance (20%), followed by control of time and scheduling (13%) and improving health and safety (12%).

Importantly, construction businesses don’t only understand the benefits that digital can bring – they’re acting on it. Nearly three quarters say they are prioritising digital transformation (72%). For most firms, the budget for technologies represents 1-3% of their annual turnover (32%).

Firms have invested in some tools, with enterprise resource planning (51%) and project management software (51%) topping the list globally. Across Europe, almost one in ten firms report that everyone uses BIM-based workflows in their day to day operations (9%) – compared to an average of 7% worldwide.

Further Reading: Start Your Digital Construction Journey: A Transformation Road Map [Infographic]

Nonetheless, construction businesses are at an early point with their transformations. Most are still in stage one (34%) – where digital initiatives are ad hoc – or stage two (24%), where execution happens on a project by project basis. Only 13% of businesses are well on their way to success. Worldwide 95% of organizations worldwide use digital construction solutions in just 50% or less of their projects.

Watch webinar

So what’s holding back construction businesses in Europe? The most common cause of digital deadlock is the lack of a strategic roadmap for digital investments (54%): in other words, knowing which areas to prioritise. Integrating digital projects across the organisation (45%) and finding the metrics to measure digital success (31%) are also frequent stumbling blocks.

But European businesses also have other organisational issues to content with. Nearly two in ten professionals point to the challenges of effectively managing risk (16%) and ensuring data security (16%), which is perhaps unsurprising in an area with very strict data regulation. A further one in ten are concerned about completing projects on time and on budget.

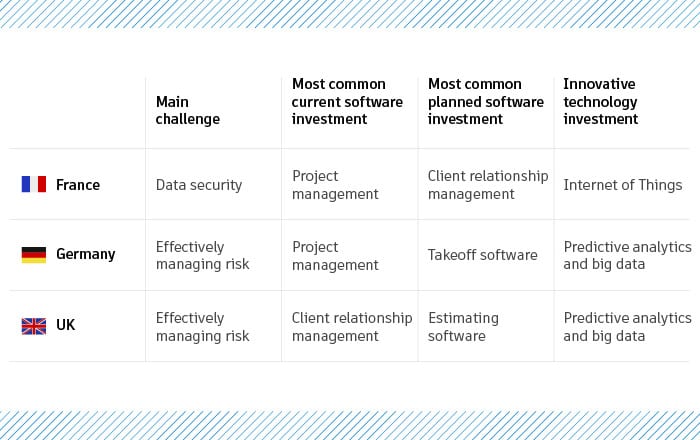

France – Digital adoption in France is being driven by the continuing challenge of labour shortages. Over two in five (41%) firms use BIM, and 500,000 houses were built in 2017 with the technology.

Germany – The German construction sector is looking at the adoption of prefabrication and green technology. Nearly a third of firms are planning to adopt BIM technology in the future (31%).

UK – Construction firms in the UK are focusing on data-driven construction and informed forecasting. The country is a leader in BIM adoption, which has been mandatory in public sector projects since 2016.

Construction firms around the world are planning to invest in more technology in the future. Importantly, many construction businesses are also planning to establish a digital transformation roadmap, to guide their technology investments. Three in ten firms plan to establish their roadmap in the next 12 months, while 25% are looking at the next 12-24 months.

Digital capabilities will be improved in several areas across the business. Nearly half of construction firms plan to prioritise operational excellence with their digital investments (48%). For others, it will be about creating strong customer relationships on projects (44%) and capitalising on the data in the business (39%). A fifth will also focus on digital skills and talent (21%), which will be important for gaining the full benefits of new technology.

Digital transformation is far from straightforward, but there are steps that firms in Europe and beyond can take to secure success:

With digital transformation, construction firms can improve their productivity, meet rising client expectations and take advantage of new methodologies. European construction firms have made a bright start in their digital journeys – and with continuing investment in the coming years, they can create an industry that’s ready for the future.

To get a global view of digital transformation in construction, download the IDC whitepaper – Digital Transformation: The Future of Connected Construction