The global average value of construction disputes was $52.6 million, according to Arcadis’ 2022 Global Construction Disputes Report. This fact, coupled with what we have witnessed playing out in the Australian press recently, there is no doubt construction disputes can have some devastating effects for all involved.

In a bid to mitigate the very real risks with how funds are managed on a construction project, the Queensland government has introduced new rules for building and construction businesses. With the Sunshine State shining a light on a new approach to tackle the issue, it may not be long before we see similar rules around the country or even region.

Queensland’s Project Trust Account framework is designed to strengthen the security of payments to subcontractors in the state’s building and construction industry. This is accomplished by requiring head contractors to hold money, that is paid by a project principal, in a separate bank account on trust for the benefit of the subcontractors of the project.

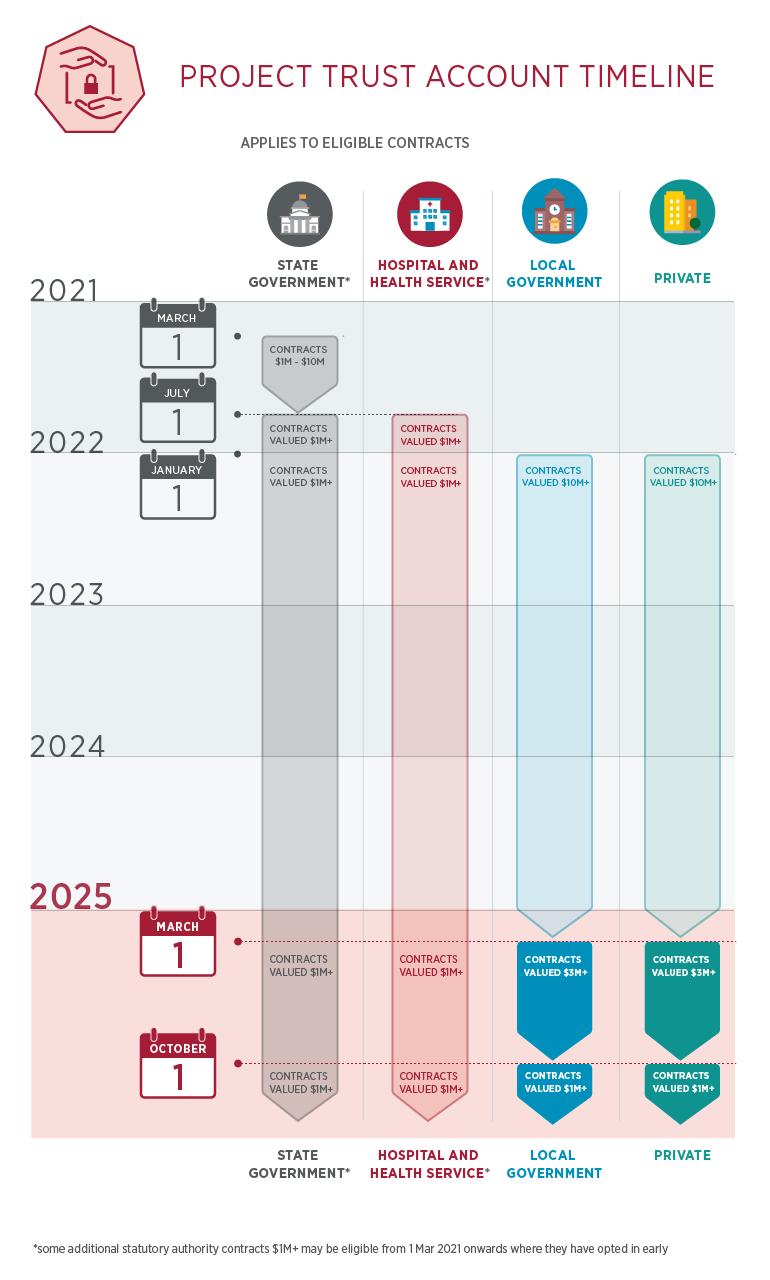

Delivered over five major phases, the trust account framework will progressively expand over time to capture more eligible contracts and contractors.

Image source: Queensland Building and Construction Commission

Key impact on the industry

The biggest impact the framework will have on the industry is the sheer amount of administrative work that will need to be done to ensure compliance with the required legislation. This includes records for legislative requirements such as the Building Industry Fairness (Security of payment) Act 2017 (QLD) (BIF Act).

Here’s how connected construction can help ease some of that admin burden:

Enhancing record-keeping: Paper purchase orders and invoices are hard to keep track of. Instead, keeping documentation in a digital format can help construction companies maintain accurate records of payments, receipts, and other financial transactions. This can assist builders in complying with the state's trust account framework, which requires the keeping of detailed records for all account transactions.

Streamlining payment processes: Digital payment platforms can make payment processes faster and more accurate. This, in turn can ensure that payments are made promptly and that there are no discrepancies in the amounts being paid.

Increasing transparency: Automating workflows can provide greater transparency into the construction process, including the use of trust account funds. By providing clients and other stakeholders with access to digital records, construction companies can demonstrate that they are complying with the state's trust account framework. This is especially useful for the independent audits that the framework requires.

Improving communication: A digital platform such as Autodesk Build can ensure a single source of truth for all. This will enable the relevant parties to communicate more effectively regarding payments, payment schedules and other important details.

Enhancing security: Digitalisation can improve the security of financial transactions via encryption and other security measures. This allows for fraud prevention and other financial crimes – especially important when large sums of money are often at stake.

Overall, digitalisation can provide significant benefits to the building and construction industry in Queensland, particularly with respect to the state's trust account framework.

In addition to the above positive outcomes, it’s understandable that there would still be concerns about how this framework could impact a builder’s cash flow and risk profile. For a deeper dive into these topics, take a look at the Autodesk Cost Management Toolkit to discover how the right technology can help improve the financial health of your projects.

May we collect and use your data?

Learn more about the Third Party Services we use and our Privacy Statement.May we collect and use your data to tailor your experience?

Explore the benefits of a customized experience by managing your privacy settings for this site or visit our Privacy Statement to learn more about your options.